Inflation overview

I always start off by looking at my inflation indicators below.

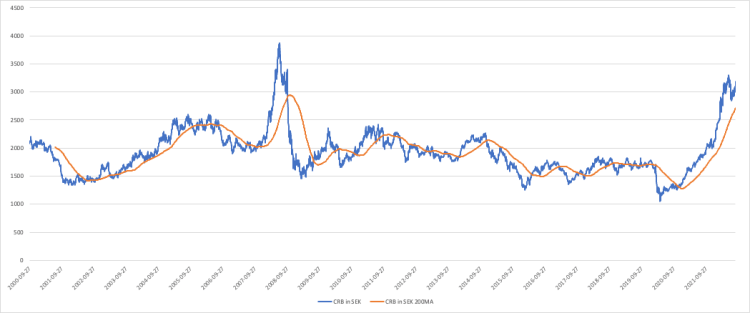

First I look at the CRB index in SEK since SEK is where I consume goods living in Sweden and this is the inflation that I am mostly concerned about.

During 2007/2008 we were at peak levels higher than we are currently though so I am thinking that we probably should reach peak levels within short. As for my investment models though this indicator is still flashing red hot inflation.

CPI change is next up and this is still raging as shown by the chart above. Looking at the longer term chart we get some perspective though.

Gold compared to SEK is continuing to hold up too with an upward sloping moving average which the price has been bouncing against.

Finally as an inflation gauge I look at the real interest rate in Sweden which I measure as the 10 year Swedish Government Bond compared to the CPI change. This one is still at a negative -6.66 % and even though I like this song which talks about this number 🙂 I would rather see something else.

Inflation summary

All my indicators to gauge inflation is flashing red for continued inflation which means that I still want to keep a lot of inflation protection by being invested into interest generating products with SEK exposure like preference shares, D-shares and Bonds. I also like various forms of corporate loans which I want to participate in. Marcus Hernhag has a lot of very good articles about this in Sweden.

I usually keep exposure to commodities like gold and other assets through instruments like these Amundi Physical Gold ETC and iShares Diversified Commodity Swap. I have had such good runs in these products though so I took all that exposure off during the summer and at these levels I do not want to re-establish them.